Malaysia's anti-dumping duties on Chinese cold-rolled stainless steel range from 2.68% to 26.38%, depending on product type and company. The following are the rates:

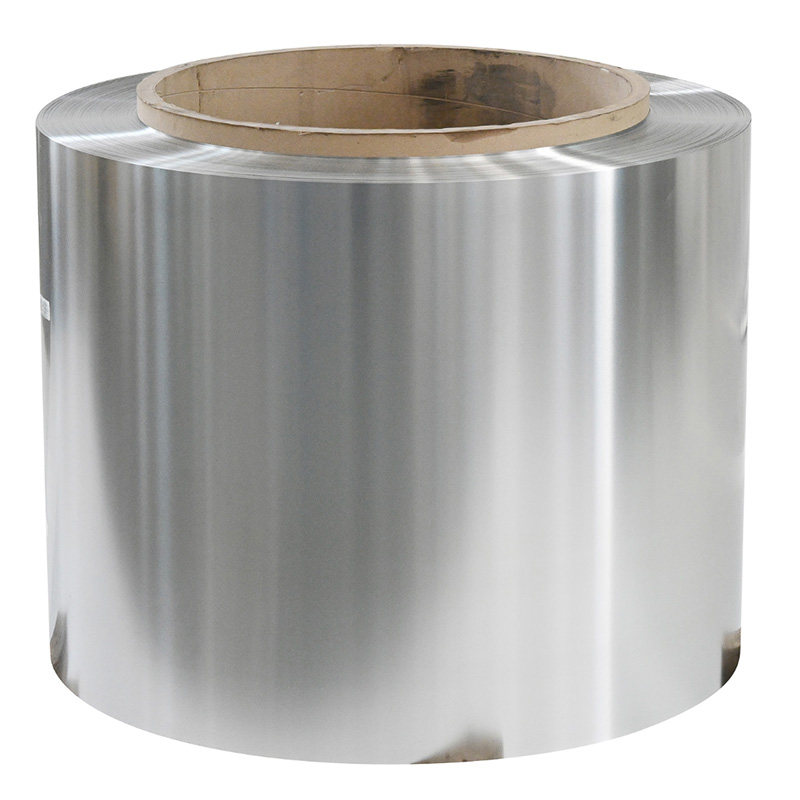

Cold-Rolled Stainless Steel Coil (Thickness 0.3-6.5mm, Width ≤1600mm)

Shanxi Taigang Stainless Steel Co., Ltd.: 2.68%

As a major Chinese stainless steel producer, this company received a lower duty rate, reflecting the perception that its export prices were less damaging to the Malaysian market.

Other Chinese Producers/Exporters: 23.95%

Except for certain companies, other Chinese exporters are subject to a higher duty rate, reflecting Malaysia's determination of dumping on all Chinese cold-rolled stainless steel coil exports.

Tariff Background:

This duty rate is based on the final ruling of the first anti-dumping sunset review on July 26, 2023, and is effective until July 26, 2028. The Malaysian Ministry of International Trade and Industry, through an investigation, has determined that Chinese cold-rolled stainless steel coils are being dumped and causing injury to the local industry. Therefore, anti-dumping duties are being maintained.

Cold-rolled Steel Coil (Iron or Non-alloy Steel, Width ≥ 1300mm)

Ansteel Group Co., Ltd.: 4.82%

Maanshan Iron & Steel Co., Ltd.: 4.76%

Shougang Jingtang United Iron & Steel Co., Ltd.: 8.74%

Other Chinese Producers/Exporters: 26.38%

Tariff Background:

This tariff is based on the final ruling of the first anti-dumping sunset review on June 21, 2025, and is effective until June 22, 2030.

The Malaysian Ministry of Investment, Trade and Industry, through an investigation, has determined that Chinese cold-rolled steel coils are being dumped and causing injury to the local industry. Therefore, anti-dumping duties are being maintained.

Notably, anti-dumping duties on similar products from South Korea and Vietnam have been lifted, as the investigations have determined that there is no dumping or injury.

Reasons for Tax Rate Differences

Individual Enterprise Differences:

Certain enterprises (such as Shanxi Taiyuan Iron and Steel and Anshan Iron and Steel) may receive lower tax rates due to differences in export prices, cost structures, or market strategies.

Other enterprises, unable to justify their export prices, are subject to higher tax rates.

Product Type Differences:

Cold-rolled stainless steel coil and cold-rolled steel coil (iron or non-alloy steel) belong to different product categories and are subject to different tax rates.